The Ultimate Crypto Research Guide

The cryptocurrency market is vast and offers a lot of opportunities. However, with over 13,000 cryptocurrencies in circulation as of March 2024 and new projects launching daily, navigating the space requires diligent crypto research.

Whether you're a pro investor or a beginner, this guide will walk you through how to effectively conduct cryptocurrency research and make informed decisions.

Why Crypto Research Matters

Before we start talking about research, it is important to understand why you need to start your crypto journey with research:

- There are so many myths in the crypto space. Good research will calm your fears and help you focus to identify credible projects.

- Maximize Returns: Understanding a project's fundamentals ensures you invest in tokens with strong long-term potential and maximize returns

- Knowing the market landscape helps you spot opportunities before others.

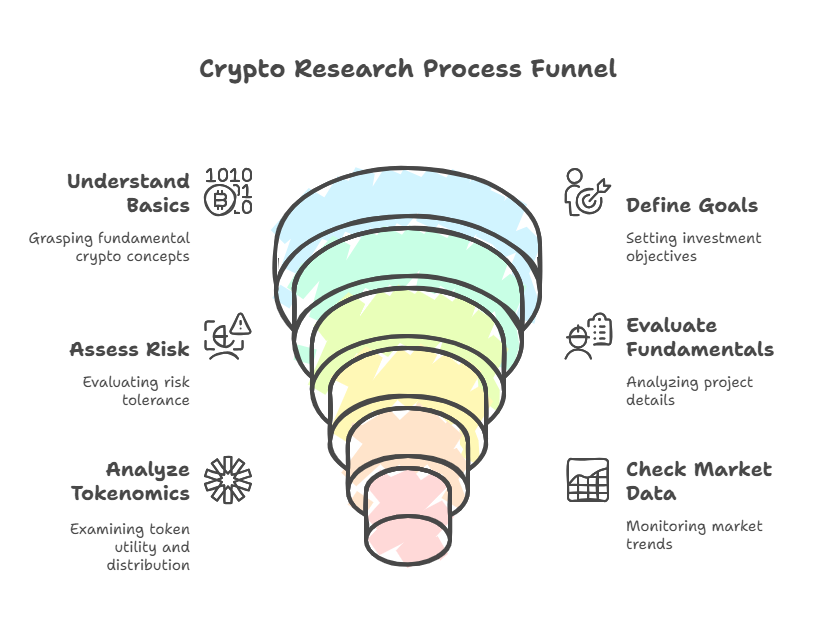

How To DO Crypto Research

Step 1: Understand the Basics of Cryptocurrency

Before researching specific projects, you need a foundational understanding of blockchain and cryptocurrency. Make sure you understand what crypto is, the types of cryptocurrencies, and their use cases

You should also be familiar with crypto-related terms such as blockchain, tokenomics, market cap, decentralization, and whitepaper.

Step 2: Define What You Want

Are you investing for the short term or long term? Are you a trader or looking to HODL? Understanding your investment goals will help you focus on projects that align with your strategy.

Step 3: Assess Your Risk

It is most likely that you may lose money, so you should assess your risk tolerance. Smaller market cap coins might offer higher returns but come with higher risks, while established coins like Bitcoin and Ethereum are relatively stable options.

Step 4: Research the Fundamentals

The backbone of any cryptocurrency project lies in its fundamentals. Here's what to look out for:

The Whitepaper

- The whitepaper explains the project's vision, use case, and technical details.

- Look for key details such as the problem the project aims to solve, the blockchain it operates on, token distribution, and roadmap.

- Example: Bitcoin's whitepaper laid out the idea of a decentralized, peer-to-peer digital currency.

The Team

- A credible project often has a transparent and experienced team.

- Research team members on LinkedIn and other platforms. Look for strong technical backgrounds, blockchain expertise, and prior successes.

- Example: Ethereum co-founder Vitalik Buterin’s expertise brought credibility to the project.

Community and Partnerships

- A strong and active community (on Twitter, Discord, or Telegram) indicates a project’s growing interest.

- Look for partnerships with reputable companies or organizations, as these can validate a project’s legitimacy.

Technology and Use Case

- Is the project solving a real-world problem?

- Evaluate the blockchain’s scalability, security, and transaction speed.

Step 5: Analyze Tokenomics

Tokenomics refers to the economic model of the cryptocurrency. When analyzing the tokenomics of any project, here are things you should consider:

- Supply: What is the total supply and circulating supply? Cryptocurrencies with a capped supply, like Bitcoin, are often deflationary, while others may be inflationary.

- Utility: What can the token be used for? Examples include governance, staking, payments, or gas fees for transactions.

- Distribution: How are tokens distributed? If a small percentage of wallets hold a significant supply (whales), the price can be easily manipulated.

Step 6: Check Market Metrics

Use crypto tracking platforms like CoinMarketCap or CoinGecko to analyze market metrics:

- Market Capitalization: A measure of a cryptocurrency's size and stability. Higher market caps often indicate less volatility.

- Volume: High trading volumes signify strong interest and liquidity in the market.

- Price History: Study historical price charts to understand past performance and potential trends.

Step 7: Check The News

The crypto market is heavily influenced by news and community sentiment, and sometimes, this can affect the market. Follow reputable crypto news platforms like CoinDesk, and Decrypt to stay informed.

Additionally, you should monitor platforms like Twitter and Reddit to gauge public sentiment. Tools like LunarCrush can help measure social media influence.

Step 8: Investigate Risks

While researching, consider potential risks that could affect your investment. Check if the project has faced security breaches, assess whether it is under regulatory scrutiny, and compare it to competitors to evaluate its market position.

Step 9: Use Analytical Tools

You should also leverage blockchain and data analytics tools to deepen your research:

- Glassnode: Offers on-chain analytics for Bitcoin and other major cryptocurrencies.

- Messari: Provides comprehensive research reports on various crypto projects.

- DeFi Pulse: Tracks decentralized finance (DeFi) protocols and projects.

Step 10: Diversify Your Research Sources

Don’t rely solely on a single source of information. Compare findings from various platforms, communities, and tools to avoid falling for biases or misinformation.

Step 11: Start Small and Stay Cautious

Once you’ve completed your crypto research, start small. If you want to trade, this crypto trading guide for beginners can help you. Make sure you test the waters before committing a significant portion of your capital to any cryptocurrency. Remember, the crypto market is highly volatile, and prices can swing unpredictably. You can

Conclusion

Whether you’re trading or HODLing for the long term, informed decisions are your best defense in the ever-changing crypto space.

Start your crypto research today and make smarter investment moves in the world of cryptocurrency!