How to Prepare for the Next Bitcoin Halving: A Step-by-Step Guide

The most recent Bitcoin halving has come and gone, leaving everyone analyzing its impact and strategizing for the future.

Bitcoin halving events occur approximately every four years, reducing mining rewards by 50%. Historically, these events have influenced Bitcoin’s price, mining activity, and overall market sentiment.

Understanding what happened in the latest halving and how to prepare for the next one is crucial for investors looking to maximize their gains.

So, if you are part of the fraction of people with no idea what the Bitcoin halving event is about, you just stumbled on the right article. You can also explore our Crypto Trading for Beginners guide to build a solid foundation on trading

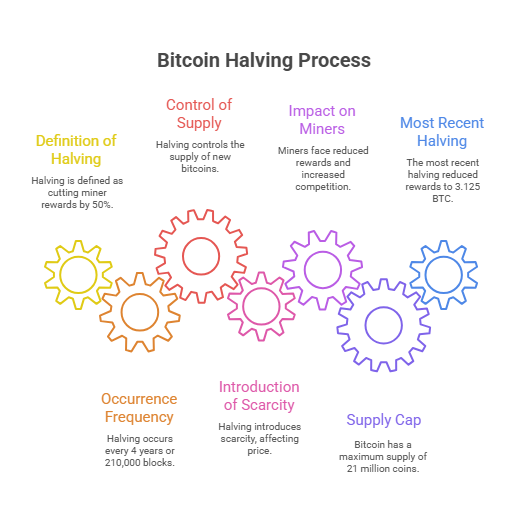

What is Bitcoin Halving?

In the world of Bitcoin, a block-halving event is an important occurrence that directly affects the cryptocurrency's supply and mining rewards.

Bitcoin halving is an event that occurs approximately every four years, reducing the reward that miners receive for verifying transactions by 50%. This process helps control Bitcoin’s supply, making it scarcer over time, which can influence its price and market dynamics.

Bitcoin block-halving events happen roughly every four years (every 210,000 blocks mined) and serve to decrease the rate at which new Bitcoins enter circulation gradually. This has helped to control inflation and increase the value of existing Bitcoins over time due to scarcity. Bitcoin's total supply is capped at 21 million coins.

The reward for successfully mining a new block is cut in half during a halving event. This means miners—the individuals who verify transactions and secure the network—receive 50% fewer bitcoins per block they mine.

The last halving event took place in 2024, reducing the mining reward from 6.25 BTC to 3.125 BTC per block.

Key Takeaways from the 2024 Bitcoin Halving

- Reduced Mining Rewards: Miners now earn fewer BTC for their efforts, impacting profitability.

- Market Reaction: Bitcoin's price saw fluctuations before and after the halving.

- Network Security: Some miners exited the network, but overall security remained strong.

- Institutional Interest: More institutional investors entered the space, anticipating long-term gains.

How It Affects the Market

Supply & Demand

With mining rewards halved, each halving event reduces the influx of new Bitcoins into the market. This naturally induces scarcity, and increases the value of Bitcoins in circulation. Theoretically, this surge in value is supported by either a surge in demand or a steady, sustained level of interest.

Taking Advantage of the Halving Event

The Bitcoin halving event happened on the 19th of April, 2024, and the mining reward is now 3.125 BTC per block. Here are some of the things you could do to take advantage of the halving event

- Analyze Post-Halving Market Trends

The 2024 halving has provided valuable insights into price movements, mining activity, and investor behavior. By studying past trends, you can better anticipate future price shifts and position your portfolio for maximum gains. - Accumulate Bitcoin Strategically

Since previous halvings have historically led to long-term price growth, you might consider using a dollar-cost averaging (DCA) strategy. This approach allows you to accumulate Bitcoin gradually while minimizing the risks of market volatility. For this, having access to the Best Crypto Trading Apps in Nigeria can make your investment process smoother and more efficient. - Diversify Your Crypto Investments

While Bitcoin remains the most dominant cryptocurrency, diversifying your investments into altcoins, DeFi projects, and blockchain-based assets can help you spread risk and capitalize on the broader crypto market’s growth. To avoid common pitfalls while doing this, check out The Beginner’s Guide to Avoid Crypto Investment Mistakes. - Monitor Mining Developments

Miners play a crucial role in Bitcoin’s security and supply. Keeping an eye on hash rate changes, mining profitability, and new mining technologies can help you stay informed about the network’s health and potential investment opportunities. - Stay Updated on Regulatory Changes

Crypto regulations are constantly evolving worldwide. Understanding how new policies might impact Bitcoin and the broader crypto market will help you make informed decisions and adjust your investment strategy accordingly.

Lessons from Previous Halvings

A breakdown of the price movements after each halving event:

- 2012 Halving: The price went from around $12 before the halving to over $1,100 a year later. (an increase of over 90 times)

- 2016 Halving: The price went from around $400 before the halving to over $8,000 a year later. (an increase of over 20 times)

- 2020 Halving: The price went from around $7,000 before the halving to over $60,000 about a year and a half later. (an increase of over 8 times)

The 2024 halving is still unfolding, but institutional adoption and mainstream integration are shaping its impact.

Road to the Next Bitcoin Halving

The next Bitcoin halving is expected to take place in 2028, further reducing the supply of new coins. This could impact future price trends, but the market remains unpredictable.

To stay ahead, make sure you stay informed, adapt to market shifts, and use strategies that align with your financial goals.